Beyond Borders: Optimizing Financial Privacy and Protection With Offshore Depend On Services

Are you looking to optimize your monetary personal privacy and security? Look no more than offshore trust fund services. In this write-up, we will dive into the relevance of offshore counts on for economic privacy and clarify the legal structure that controls these services. Discover the advantages and advantages of using offshore depends on for included safety and security, and gain understandings into choosing the appropriate offshore trust fund provider. Obtain ready to check out approaches that will assist guard your assets across borders.

The Significance of Offshore Trusts for Financial Personal Privacy

One of the vital advantages of overseas depends on is the capability to maintain your monetary details confidential. Unlike typical onshore counts on, offshore trust funds offer a greater degree of privacy and discernment. These territories have rigorous policies in area that safeguard the identification of the trust's beneficiaries, making certain that their monetary events remain confidential.

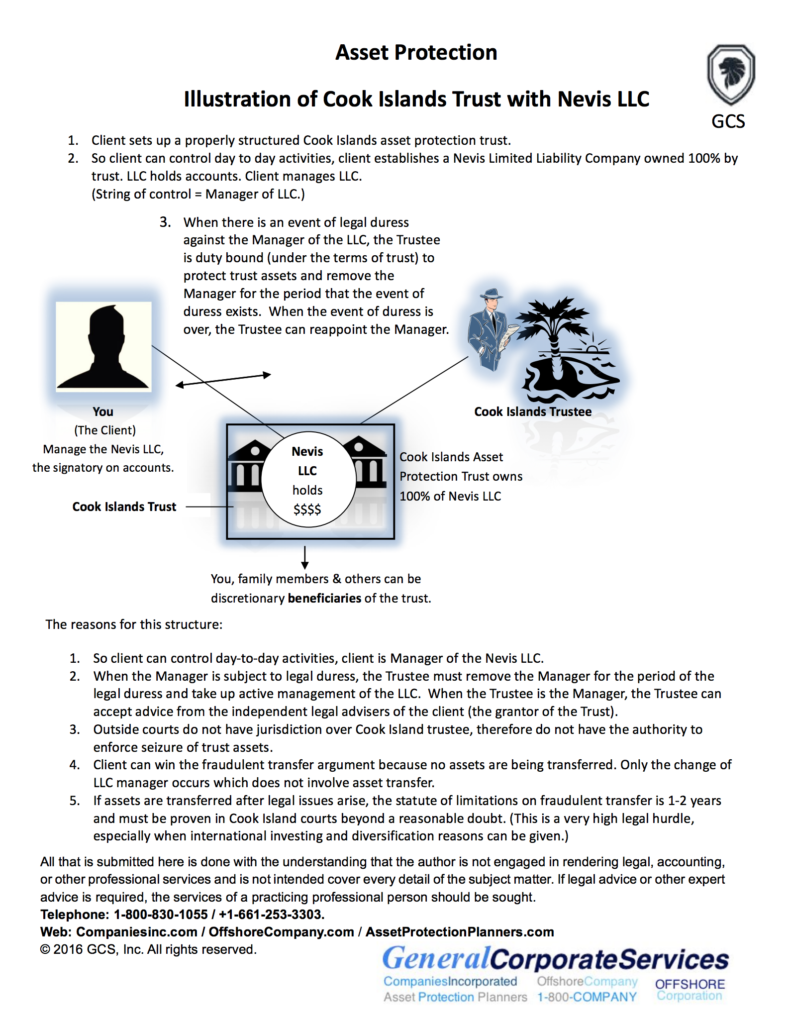

Along with discretion, offshore counts on give protection against prospective lawful claims and lenders. By relocating your possessions offshore, you can develop a lawful barrier that makes it challenging for lenders or litigators to seize your riches. This added layer of security can supply comfort and safeguard your financial future.

In addition, offshore counts on can likewise provide tax advantages. Lots of overseas territories supply desirable tax obligation regimens that allow you to reduce your tax obligation obligations lawfully - offshore trustee. By tactically structuring your depend on, you can make the most of these tax obligation advantages, possibly saving significant quantities of cash

Recognizing the Lawful Structure for Offshore Trust Solutions

Comprehending the legal framework for overseas depend on solutions can assist you safeguard your assets and ensure conformity with appropriate guidelines. Offshore depends on go through a collection of legislations and regulations that govern their facility and operation. These laws differ from territory to jurisdiction, so it is important to familiarize on your own with the certain legal demands of the overseas jurisdiction in which you plan to develop your count on.

One crucial facet of the legal framework for overseas trusts is the idea of asset protection. Offshore counts on are often utilized as a way to secure possessions from lawful claims or possible creditors. By positioning your assets in an overseas trust, you can produce a legal obstacle that makes it harder for financial institutions to accessibility and confiscate your properties.

An additional trick element of the legal structure is tax preparation. Numerous overseas jurisdictions use favorable tax obligation programs, permitting you to reduce your tax obligation liability and maximize your monetary returns. It is vital to comprehend the tax obligation regulations of both your home country and the offshore jurisdiction to make sure conformity with all relevant tax obligation regulations.

In addition, offshore trust services go through anti-money laundering (AML) and know-your-customer (KYC) laws. These regulations aim to avoid cash laundering, terrorist funding, and various other illicit activities. Comprehending and sticking to these laws is crucial to preserving the legitimacy and stability of your overseas depend on.

Advantages and Advantages of Using Offshore Depends On for Security

Another benefit of utilizing offshore counts on is the possession defense they give. By transferring your assets into a depend on situated in a territory with solid property protection laws, you can shield your riches from lenders, claims, and various other economic threats. This can offer you satisfaction understanding that your possessions are secured and safe.

Furthermore, offshore trusts can provide tax obligation advantages. Some territories provide beneficial tax regimens, permitting you to potentially decrease your tax obligation responsibility. By structuring your possessions in a tax-efficient way, you can lawfully reduce your tax obligation commitments and keep more of your wide range.

Last but not least, offshore trusts can additionally supply estate planning benefits. By developing a depend on, you can guarantee that your assets are dispersed according to your wishes, also after your death (offshore trustee). This can help prevent probate and lengthy lawful procedures, ensuring a smooth transfer of wide range to your beneficiaries

Key Factors To Consider When Selecting an Offshore Trust Fund Provider

To make certain a successful option process, you need to extensively research study and evaluate prospective overseas count on companies based upon their proficiency, track record, and experience. When it concerns shielding your financial possessions and optimizing your privacy, selecting the right offshore count on service provider is vital. Beginning by conducting an extensive history examine each possible service provider. Explore their credibility within the sector and amongst their customers. Look for reviews and reviews to get a better understanding of their performance history.

Look for a carrier with a tested track document of success in taking care of offshore depends on. Make sure the provider has a deep understanding of the legal and economic intricacies involved in offshore depend on solutions.

Additionally, it is necessary to analyze the variety of solutions supplied by each provider - offshore trustee. Identify whether they can satisfy your details demands and objectives. Consider pop over to this site their capacity to provide tailored options that line up with your economic purposes

Lastly, don't forget to assess the supplier's customer care. You wish to choose a supplier that is receptive, trusted, and committed to your satisfaction. Make the effort to talk with their agents and ask concerns to evaluate their level of professionalism and attentiveness.

Exploring Strategies to Safeguard Your Assets With Offshore Trusts

To discover approaches for guarding your properties with overseas counts on, think about talking to a financial advisor that concentrates on global riches management. They can guide you via the procedure and assist you make informed decisions. One approach is to expand your properties geographically. By positioning a few of your wealth in overseas trust funds, you can shield it from possible risks in your home other nation. Offshore trust funds use improved privacy and possession protection, securing your possessions from suits, creditors, and various other monetary risks. In addition, you can additionally profit from tax obligation benefits by establishing an offshore depend on. Some territories use positive tax plans, allowing you to decrease your tax obligation responsibilities legitimately. Another strategy is to develop a count on guard. This individual or entity makes certain that the trustee complies with the regards to the count on and acts in your ideal interests. They have the power to get rid of or change the trustee if required. Additionally, overseas counts on can give estate planning benefits. By putting your properties in a trust, you can dictate exactly how they will certainly be taken care of and distributed after your death, making certain that your loved ones are cared for according to your dreams. Overall, offshore depends on can be a beneficial tool for protecting your possessions and taking full advantage of economic personal privacy and security. Consulting with a financial consultant that concentrates on international wealth management is vital to browse the intricacies and maximize these techniques.

Conclusion

In verdict, utilizing overseas trust services is crucial for optimizing your economic privacy and protection. Protecting your properties becomes much easier with overseas counts on, permitting you to protect your riches past borders.

Discover the benefits and benefits of making use of offshore trust funds for added protection, and gain insights into picking the best offshore trust provider. Unlike traditional onshore counts on, offshore trust funds offer a greater level of browse around these guys personal privacy and discretion. By putting your assets in an overseas count on, you can produce a lawful obstacle that makes it much more tough for lenders to accessibility and seize your assets.

By positioning your properties in an offshore count on, you can keep your monetary and individual details private, as these trusts are subject to strict privacy laws and regulations. Offshore counts on offer enhanced privacy and asset defense, securing your properties from claims, financial institutions, and various other economic dangers.